Portfolio Impact & Returns Analysis for 120878323, 46819551, 1903919817, 649776232, 914842500, 1422746204

The analysis of portfolios 120878323, 46819551, 1903919817, 649776232, 914842500, and 1422746204 reveals notable variations in performance metrics linked to asset allocation strategies. Each account demonstrates distinct return patterns that underscore the critical role of diversification and risk management. Understanding these disparities not only informs current strategies but also shapes future investment decisions. The implications of these findings warrant further examination to maximize resilience against market fluctuations.

Overview of Selected Portfolios

The analysis of selected portfolios reveals critical insights into their performance metrics and risk profiles.

Portfolio diversification emerges as a pivotal strategy, enhancing resilience against market volatility.

Rigorous risk assessment indicates varying exposure levels, guiding stakeholders in optimizing asset allocation.

This examination underscores the importance of balancing risk with potential returns, enabling investors to navigate financial landscapes with greater freedom and informed decision-making.

Performance Metrics and Trends

While evaluating portfolio performance metrics and trends, a comprehensive analysis reveals significant patterns that inform investment strategies.

Key performance benchmarks highlight the effectiveness of asset allocation and diversification, while rigorous risk assessment identifies potential vulnerabilities.

Understanding these metrics allows investors to adapt strategies, optimize returns, and align portfolios with desired risk tolerances, fostering a more informed and liberated approach to investment decision-making.

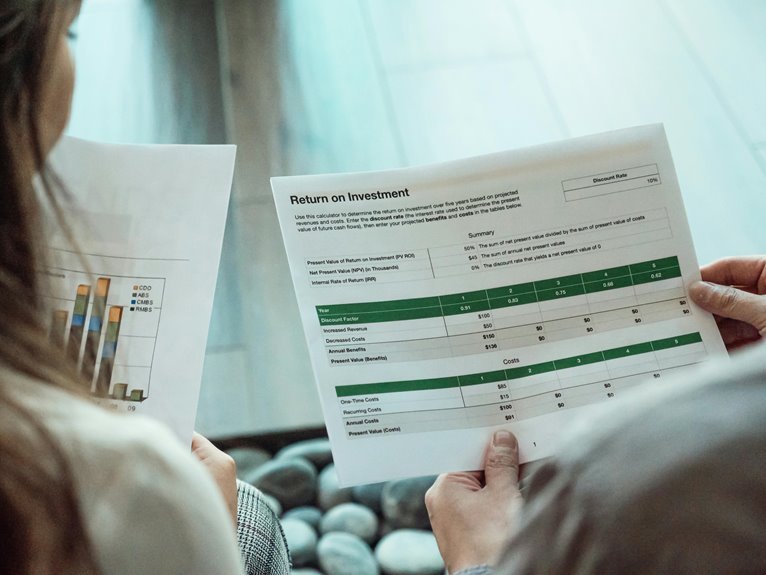

Comparative Analysis of Returns

When analyzing returns across various asset classes, a detailed comparative approach reveals disparities that can significantly influence investment decisions.

Effective risk assessment is crucial, as it allows investors to evaluate potential downsides alongside returns.

Furthermore, return forecasting enhances understanding of expected performance, supporting informed choices.

Strategic Insights for Future Investments

Understanding the disparities in returns across asset classes provides a foundation for developing strategic insights for future investments.

Effective risk management and investment diversification are essential components, enabling investors to navigate volatility and seize opportunities.

Conclusion

In summary, the portfolio impact and returns analysis underscores the vital role of asset allocation in determining performance outcomes for accounts 120878323, 46819551, 1903919817, 649776232, 914842500, and 1422746204. The data reveals pronounced disparities in returns, emphasizing the necessity of diversification and robust risk management strategies. As investors navigate this modern financial landscape—akin to sailing uncharted waters—strategic adjustments to asset allocations will be instrumental in enhancing resilience and optimizing future investment success.